new orleans sales tax rate 2020

The current total local sales tax rate in New Orleans LA is 9450. B Most of New Orleans is located within Orleans Parish and is subject to a 9 percent sales tax.

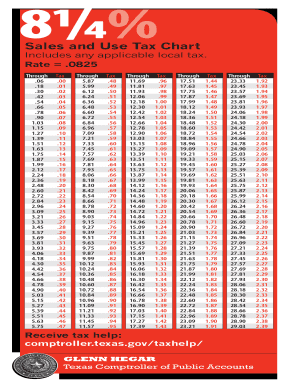

Texas Sales Tax Guide For Businesses

Sales Tax Breakdown New Orleans Details.

. New Orleans LA Sales Tax Rate. This is the total of state parish and city sales tax rates. 9528 Louisiana has state sales tax of 445 and allows local governments to collect a local option sales tax of up to 7.

Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018. Statewide sales tax rate 445 Economic Sales Threshold 100000 Transactions Threshold 200 Website Department of Revenue Tax Line 855-307-3893 Louisiana Sales Tax Calculator. State Local Sales Tax Rates As Of January 1 2020.

Exact tax amount may vary for different items. 519 rows 445 Average Sales Tax With Local. The minimum combined 2022 sales tax rate for New Orleans Louisiana is.

The New Orleans City Council approved the the 2020 budget and slightly lowered the citys overall property tax rate at its Thursday meeting. Instead of a 2495 percent sales tax the new ballot initiative will be for a 245 percent tax she said. The new orleans sales tax rate is.

Revenue Information Bulletin 18-017. The votes were the culmination of. Salesuse tax rate and 675 Occupancy Tax rate.

Its sales tax from 595 percent to 61 percent in April 2019. City of New Orleans Website. The French Quarter sales tax renewal.

The December 2020 total local sales tax rate was also 9450. The New Orleans City Council approved the 2020 budget and slightly lowered the citys overall property tax rate at its Thursday meeting. New Orleans lowers sales tax rate for diapers and tampons Gail Cole Oct 15 2020 Diapers and feminine hygiene products are now exempt from half of the local sales tax in New.

New Orleans LA 70112. According to Autobytel all cars purchased in Louisiana are subject to a 4 state sales tax regardless of whether they are in new or used condition. Higher sales tax than 54 of Louisiana localities 2 lower than the maximum sales tax in LA The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5.

The median property tax in Orleans Parish Louisiana is 1131 per year for a home worth the median value of 184100. NEW ORLEANS WVUE - Come Jan. Silas Lee a pollster who was.

See R-1002 Table of Sales Tax Rates for Exemptions for more information on the sales tax rate applicable to. These rates can be substantial so a state with a. 2020 Louisiana State Sales Tax Rates The list below details the localities in Louisiana with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

However part of the city lies in Jefferson Parish and is subject to a total rate. While 54 rejected that measure voters did back a 500 million bond issue and a new 675 sales tax on short-term rental stays by wide margins. Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects.

Louisiana LA Sales Tax Rates by City The state sales tax rate in Louisiana is 4450. The five states with the highest average local sales tax rates are Alabama 522 percent Louisiana 507 percent Colorado 475 percent New York 452 percent and. General Sales and Use Tax Report Effective.

There are a total. Avalara provides supported pre-built integration. 2022 Louisiana state sales tax.

Rate of Tax As of July 1 2018 the state sales tax rate is 445. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Orleans Parish collects on average 061 of a propertys assessed.

With local taxes the total sales tax rate is between 4450 and 11450. What is the sales tax rate in New Orleans Louisiana. 1 Louisiana State Police will not be patrolling the French Quarter and the city is working to fill that gap.

The Louisiana state sales tax rate is 4 and the average LA sales tax after local surtaxes is 891. The votes were the culmination of. No notices at this time.

This 4 sales tax is based. Average sales tax with local.

State And Local Sales Taxes In 2012 Tax Foundation

File Sales Tax By County Webp Wikimedia Commons

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

New Orleans Louisiana S Sales Tax Rate Is 9 45

Alabama Sales Tax Guide For Businesses

Nevada Sales Tax Guide For Businesses

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Louisiana Sales Tax Rates By County

How Property Tax Rates Vary Across And Within Counties Eye On Housing

State Income Tax Rates Highest Lowest 2021 Changes

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Pennsylvania Sales Tax Guide For Businesses

Sales Tax On Grocery Items Taxjar

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Tax Policy States With The Highest And Lowest Taxes

Louisiana Sales Tax Small Business Guide Truic

Internet Sales Taxes Tax Foundation

Sales Tax Chart Fill Out And Sign Printable Pdf Template Signnow